The sky is falling. Every Twitter thread, every message from investors, every conversation around San Francisco seems the same — alert everyone to the reality that the exuberance of 2021 is over.

There are probably those who still don’t heed the warnings. They think it was easy to raise, and it will be forever so long as we keep growing (efficiently or not). They disdain VCs and VC advice because it has been a rollercoaster — grow, grow, grow, be responsible, be responsible, be responsible. They also think that the advice is self-serving — let’s collectively send a doomsday message to get a better deal (lower prices, advantageous terms, more time). I’m not one of that audience — I think the fear/advice is genuine, their money is in our bank account, our preferred equity is in their names.

So, what is there to do about it? After all, we took the money hoping to build a great company: should we just return the money, should we stay the course, should we opportunistically spend, should we cut to the bone, should we squirrel it all away for a rainy day? There’s an asymmetry — being exceedingly bearish about the market can lead to missed opportunity, whereas being exceedingly bullish can lead to failure.

My first piece of advice is that there is no one-size-fits-all advice.

Y Combinator, our incubator, told us that the safe move is to set a goal to be “Default Alive.” Namely, if we continue at the current growth, we technically wouldn’t need to fundraise again, if the market never heats back up, we’ve moved as fast as we could and we’ve still managed to survive on our cash. If the market heats up, we can always invest more in growth.

David Sacks of Craft Ventures, who led our Seed and Series A, argues that companies need to be “Default Investable” and they provided a definition, which is a slightly relaxed version of Default Alive. A Default Investable company is excellent on a variety of classic metrics and would be able to remain alive as a result of funding (though it’s also a high bar, not quite as difficult for an early stage company as Default Alive).

Regardless, the message is — get better. It sort of reminds me of my constant efforts to lose weight — it’s important to have a scale, and Craft does a useful thing of providing a scale. I’d also like a playbook where one doesn’t exist beyond eat less (spend less), exercise more (grow efficiently) because it’s very segment dependent.

I’ll focus on lucky companies like ours that have runway.

YC’s advice is that “If you are post Series A and pre-product market fit, don’t expect another round to happen at all until you have obviously hit product market fit.” So then we need to get to product market fit. “If you address a market that really wants your product — if the dogs are eating the dog food — then you can screw up almost everything in the company and you will succeed.” — Andy Rachleff

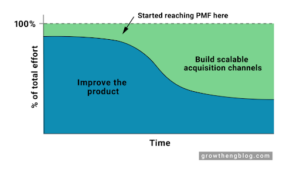

If we were growing at X% at Y efficiency and that was good enough to achieve solid metrics suitable for the next funding series, that no longer matters. Focus only on experimentation and working with customers / design partners to achieve product market fit. Typically this means engineering spend > GTM spend (sales + marketing). By shrinking the growth of your GTM team, you grow less quickly than modeled but more efficiently (the strongest leads are spread like peanut butter over fewer GTM heads and the highest performers are more efficient). If your GTM team is not acquiring revenue extremely efficiently due to a change in market conditions (harder to sell in tough times), investing in experimenting on unproven growth approaches, or past standards due to exuberance (with incredibly high multiples, even inefficient growth could be justified in company building).

The way to get to PMF is simple (and extremely hard) — experiment scientifically. Hypothesize, build, test and learn, iterate. The best way to do this is to have a technical team capable of rapid iteration. A best practice is not to do these steps in a vacuum, talk to customers and prospects (and this is where a sufficient GTM team is necessary —think of them as the best user research). Make something people want.

What is true today that wasn’t 6 months ago. Nothing. Turning back time, you could advocate for a similar disciplined growth strategy. Get product market fit, then scale efficiently, then extend that scaling. Alternatively a lot of “successful” companies played the game of increasing valuation on inefficient growth; this is a bit like a game of musical chairs that can end well if your timing is impeccable but often does not. My belief is that the likelihood of landing in one of the magical chairs, where efficiency doesn’t matter, is now miniscule.

Summing up all of this advice, we’re abandoning some of our loftiest (short-term) growth goals in favor of efficiency and communicating that with our board. Then, we plan to exclusively hire in ProdDataEng. We’ll squirrel the rest of the modeled money into a longer runway (even though we have plenty) and hope to deploy it at a more opportunistic time (either from a hiring or sales motion standpoint). We’re not going into hiding, but we are exclusively investing into building the thing customers most want (and we’ll reassess growth goals frequently).