There’s a classic line (attributed to Henry Ford) I’ve heard dozens (maybe hundreds) of times — “If I had asked people what they wanted, they would have said faster horses.” As the data geek in the room, often bringing summaries of user actions to the table, this line typically comes from a product leader with a vision that can’t be bothered with the nuisance of arguing about the assumptions and implications of the data.

Unpack it a little. Customers asking for faster horses, what’s that all about — is it just lacking a vision for the Model T? The customers knew horses, they knew faster is better, it was easy to measure faster, the historical value of the horse was proportional to the speed.

I’ve been thinking about this line a lot over the past few months. The paradigm in startups has been to grow, grow, grow. The biggest Web 2.0 winners have looked the same. Many markets have winner-take-all components that arise from the virtuous cycle of scale. My former boss, David Sacks, once shared a napkin sketch with Travis Kalanick demonstrating the network effects in rideshare. By having more geographic coverage/saturation, there would be less driver downtime (closer matches), which could mean similar economics with lower prices which would stimulate even more demand, and in turn more drivers and even greater coverage.

With enough liquidity, value creation, and operating in a market with network effects, growth is one of the best signals of the future opportunity of a company; and with low interest rates, the future opportunity has a big weight in the present value of the company. The strict relationship between growth and present value weakens as interest rates increase.

For years, founders and investors have been able to successfully proxy for company health with company growth. More complicated metrics like LTV/CAC, payback period, and burn multiple, which often look great for high growth companies as well, have not often been the North Star metric. Growth has been. Growth is easy to measure, and it’s consumable to the internal team and externally. Before affordable automobiles, horse speed was where it’s at.

Today, we live in a world where the Fed Funds Rate is climbing, and the prices of longer term bonds reflect the belief that the past two years of near zero interest rates were an anomaly. What this means to me as a founder is that while growth matters, it can no longer be relied upon alone as a good proxy for present value. To be “Default Investable” you need to achieve success in metrics that are not necessarily complex, like burn multiple, which is net burn divided by net new ARR; but it is noticeably more complex to think about as a founder than simply ARR growth.

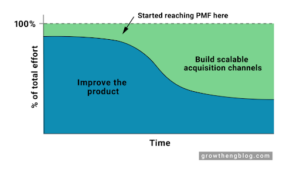

The future challenge (and this is a hard one) is to care about these more complex metrics during the good times. This takes discipline (from investors and founders). But it’s not today’s problem. How do we now achieve healthy growth when unhealthiness had been encouraged and was sometimes even a recipe for success in certain markets?

First, stop thinking about faster horses: growth. Investors will keep asking. Company employees will ask. The best companies will continue to be able to achieve it. But it is the wrong question to be asking ourselves as founders. It’s simply, what growth is profitable with shorter payback than before? One of our investors, Craft, defines “Great CAC Payback” as 6-12 months and “Good CAC Payback” as 12-18 months.

If that profitable growth is insufficient to get to Default Alive or Investable, then you must use your runway to build product, experiment, and iterate like an early stage startup to find the market pull that will generate that profitable growth. Much better than being a horse trader in Detroit in 1908!