The old saying of “a rising tide lifts all boats” hides an ocean of insight. It cuts through the boasts of those simply sitting in the boat and patting their own back for the moon’s pull. It foretells an inevitable reversal and the reminder that nothing is permanent. Most impressively is the work that word “tide” does to evoke all the trash and treasures, once covered by the sea’s smothering amnesia, revealed to the judgment of open air.

The tide is lowering as the faucet of cheap money turns off and companies will either focus on what matters or die trying. So what does matter and what should be tossed back into the bay? We’ll focus on some of the core metrics that make up a solid bottom line.

Understanding your market

Margin/Profitability: An underlying assumption of capitalism is that you’re able to sell your product/service for more than it costs to produce. This does not mean that every transaction is a profitable one — often acquiring a new customer will cost the company (i.e. first-time discount code). It also doesn’t mean that you are profitable yet, but you have a plausible path to profitability and you’re growing fast.

Customer Acquisition Cost (CAC): CAC is the cost of acquiring a paying customer. There’s a whole funnel of milestones preceding this which should be measured — cost per lead, cost per opportunity, cost per acquisition (non-paying customer), but ultimately they are in service to the goal of gaining a paying customer.

Lifetime Value (LTV): LTV is the amount of revenue a customer will generate over their entire relationship. In order to be actionable, this metric is typically an estimate of expectations, not a post-mortem accounting of a churned customer. However, it must have some basis in actuals.

Payback Period: With CAC and LTV, we have the building blocks for an impactful metric but are missing the critical factor of time. Assuming the LTV of a customer segment will eventually surpass the CAC, the crucial question becomes when. This defines the payback period — how long it takes for a customer cohort to justify the cost of acquisition. The shorter the payback period the better, with the two ways to influence it being paying less to acquire those customers or earning more revenue.

Note that the market/customer type should be considered carefully to ensure that you’re not over-optimizing for short term revenue — especially when interaction frequency varies. There’s a reason grocery stores take returns with no questions and jewelry stores don’t.

Understanding your business

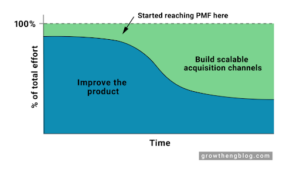

Burn Multiple: Start-ups are in the early stages of their operations — the time when investors can stomach spending to find product-market fit. Before that grace period ends, a company’s financial standing is measured by its burn rate — how quickly a company is spending money from investors before generating enough revenue to cover expenses and return a profit.

Investors and venture capitalists use various ratios to compare how successfully a company is gaining new customers/revenue against how quickly it’s spending money. David Kellogg’s Hype Factor and Bessemer’s Efficiency Score are good examples, but we prefer David Sacks’s inverted version — the Burn Multiple:

Burn Multiple = Net Burn / Net New ARR

This puts the focus squarely on burn by evaluating it as a multiple of revenue growth. In other words, how much is the start-up burning in order to generate each incremental dollar of ARR?

The higher the Burn Multiple, the more the start-up is burning to achieve each unit of growth. The lower the Burn Multiple, the more efficient the growth is.

Similar to the payback period, the power of this metric comes from its catch-all nature. A company with a poor burn multiple is either spending too much to produce its product (compared to what it can sell it for) or is struggling to attract or retain customers.

There are times when an unfavorable burn multiple is acceptable. Typically it’s the high tide when money is cheap to borrow, funding is relatively easy to acquire, and lots of bets are worth the gamble. During a down market when money is tight, successful companies are tracking their payback periods and burn multiples closely to weather the storm.

Surviving a down market is a milestone every company will eventually face and those which understand their customer and internal financials are the ones who thrive. At Mozart Data, we help companies get all their data accessible and leveraged to make a difference. Contact us to learn how we can help you.